Terneuzen, The Netherlands – 8 July 2025

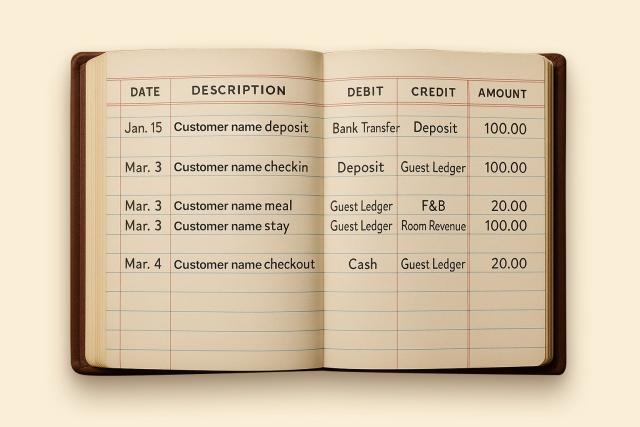

At the heart of every successful hospitality integration is a solid understanding of accounting. Whether you're connecting a PMS to an accounting platform, exporting POS summaries, or syncing folios to a city ledger, the principles behind the data matter.

This article breaks down the accounting logic that powers modern hospitality systems. No fluff, just the fundamentals every technical team should know.

What Is Accounting, and Why Does It Matter?

Accounting is the structured process of recording, summarizing, and reporting financial transactions. It serves as the financial nervous system of a hotel, restaurant or resort. It tells us:

- Are we profitable?

- Which departments perform best?

- Are we compliant and tax-ready?

- Can investors, banks, and auditors trust our records?

For integration teams, it’s not enough to push data. That data has to land correctly within this financial structure.